Register For Tax School With ATAX Westminster, CO Today!

Sección 3

11 de noviembre – 11 de diciembre de 2024

No hay clases la semana de Thanksgiving

Lunes y miércoles

5:30 PM – 8:30 PM (MST)

Modalidad: Virtual o en persona

Esta clase es en español.

Escuela de Impuestos

Ubicación

Ubicación

ATAX Westminster CO

3049 W 74th Ave Ste C

Westminster, CO 80030

Tel: 720-598-8299

$550.00

Curso de Impuestos + Copia Digital del Libro

Curso de Impuestos + Copia Digital del Libro

Lo que incluye:

- Precio del libro impreso: $625.00

- Nota: El costo total debe pagarse antes de iniciar las clases.

- Todo el material del curso es bilingüe.

- Este costo incluye el libro y acceso al portal en línea.

- Los cursos pueden ser cancelados si no se inscribe suficiente gente.

- Completar el curso no garantiza empleo, ni se requiere que los graduados trabajen para ATAX.

Inscríbete y

Tomete tu Pago

Tomete tu Pago

Nota sobre Cancelación:

Si por alguna razón no estás satisfecho, puedes darte de baja antes del primer día de clases y recibir un reembolso completo. Si cancelas antes de completar las primeras siete horas del curso, recibirás solo el 50% del monto pagado. No se realizará ningún reembolso después del segundo día de clases.

Income Tax Preparation Course

Bilingual Textbook

Bilingual Textbook

This course is a bilingual (English & Spanish) basic overview of tax preparation. Prior tax knowledge is not a requirement to take the course. This 15-chapter book is a basic overview of the Form 1040. At the end of each chapter, you will answer the chapter review questions and prepare a practice tax return. You must complete all the chapters, the final review questions and each practice tax return to receive a Certificate of Completion for the course. Everyone that successfully completes the course, is responsible for completing a new or a renewal application with the IRS for the IRS Tax Preparer Identification Number (PTIN) before the 31st of December of every year.

Tax Preparation Course

What You'll Learn In Our Course

What You'll Learn In Our Course

- Prepare most individual tax returns

- Perform a thorough interview with a taxpayer

- Determine a taxpayer’s filing status and eligibility for exemptions

- Accurately report income and deductions for a taxpayer

- Determine a taxpayer’s eligibility for credits and deductions

- Compute depreciation for assets and eligibility for Section 179

- Accurately calculate a taxpayer’s refund or balance due

- Advise a taxpayer in tax planning strategies

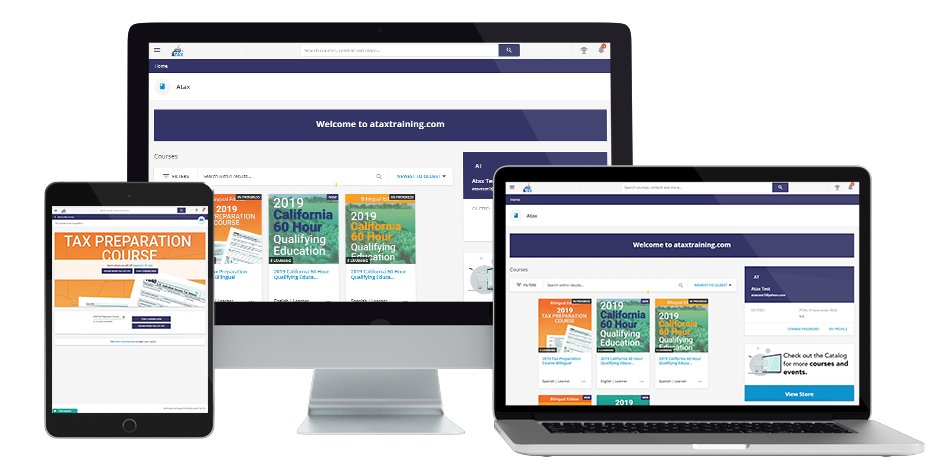

Web-Based Portal

Online Portal For Tax Preparation Practice Activities

Online Portal For Tax Preparation Practice Activities

After reading each chapter you will have to login to your own online portal to answer the review questions related to the material that you read and to prepare practice tax returns. Also, you will be able to download the PDF practice tax return scenarios and the necessary forms to prepare the tax returns by hand. You will then answer questions related to the tax preparation.

Meet Your Instructor

Enrique Medina

Enrique Medina

Enrique Medina, CPA Enrique graduated with his Masters of Science in Accounting from the University of Colorado at Denver in 2006. He later became a CPA in 2008 and has been serving the Northwest Denver Area for over 15 years. Enrique specializes in individual tax return preparation along with advisory services for businesses including business planning strategies, bookkeeping, payroll and tax return preparation.

Meet Your Instructor

Zaira Valles

Zaira Valles

I’m Zaira Valles, and I’m passionate about helping individuals and businesses navigate their taxes. Born in Brighton and raised in north Denver, I understand the local tax landscape. One of my greatest joys is teaching the same tax course I took three years ago, empowering others to excel in this field. As the Area Representative for Atax in Denver East and President of Atax Westminster, I’m dedicated to tax education and helping others grow their skills. Outside of work, I love reading, crocheting, and spending quality time with my husband, Miguel Cazares, and our four children. Fluent in Spanish and English, I’m here to help!

Meet Your Instructor

Karina Zamudio

Karina Zamudio

My name is Karina Zamudio, and I live in the Westminster area with my two children, a boy and a girl. As a team member at Atax Westminster, I have over 10 years of experience in tax preparation, helping clients navigate the complexities of the tax system. I’m also passionate about sharing my knowledge as one of the instructors for the Spanish tax school, where I help train the next generation of tax professionals. In my free time, I enjoy writing, exploring marketing strategies, and scripting radio ads, combining my creativity with my professional expertise.

Meet Your Instructor

Juan Zambrano

Juan Zambrano

For the past three years, I’ve been working in the tax industry, and I love being able to merge my knowledge of banking and taxes to better help my clients navigate their financial needs. It’s rewarding to provide holistic financial solutions that can make a real difference in people’s lives.

Meet Your Instructor

Miguel Cazares

Miguel Cazares

Miguel Cazares is a seasoned financial expert with over 13 years in the banking sector, specializing in business development. Currently, he serves as an SVP at a local bank in Colorado. Beyond banking, Migueldives into the tax world, supporting his wife, Zaira, at her ATAX office in Westminster. In 2022, he took the same tax course he now teaches, bringing a wealth of knowledge and dedication to his students. When he’s not at the bank or the tax office, you’ll find him enjoying the outdoors, running, hiking, golfing, or spending quality time with his wife and their four kids. Miguel’s passion for finance and teaching, combined with his love for family and the great outdoors, make him a relatable and dynamic professional.

Meet Your Instructor

Miguel Fierro

Miguel Fierro

Have Questions?

Call Us Today!

Call Us Today!

ATAX Westminster CO

3049 W 74th Ave Ste C

Westminster, CO 80030

Tel: 720-598-8299

Copyright ©2024. ATAX Tax Service.